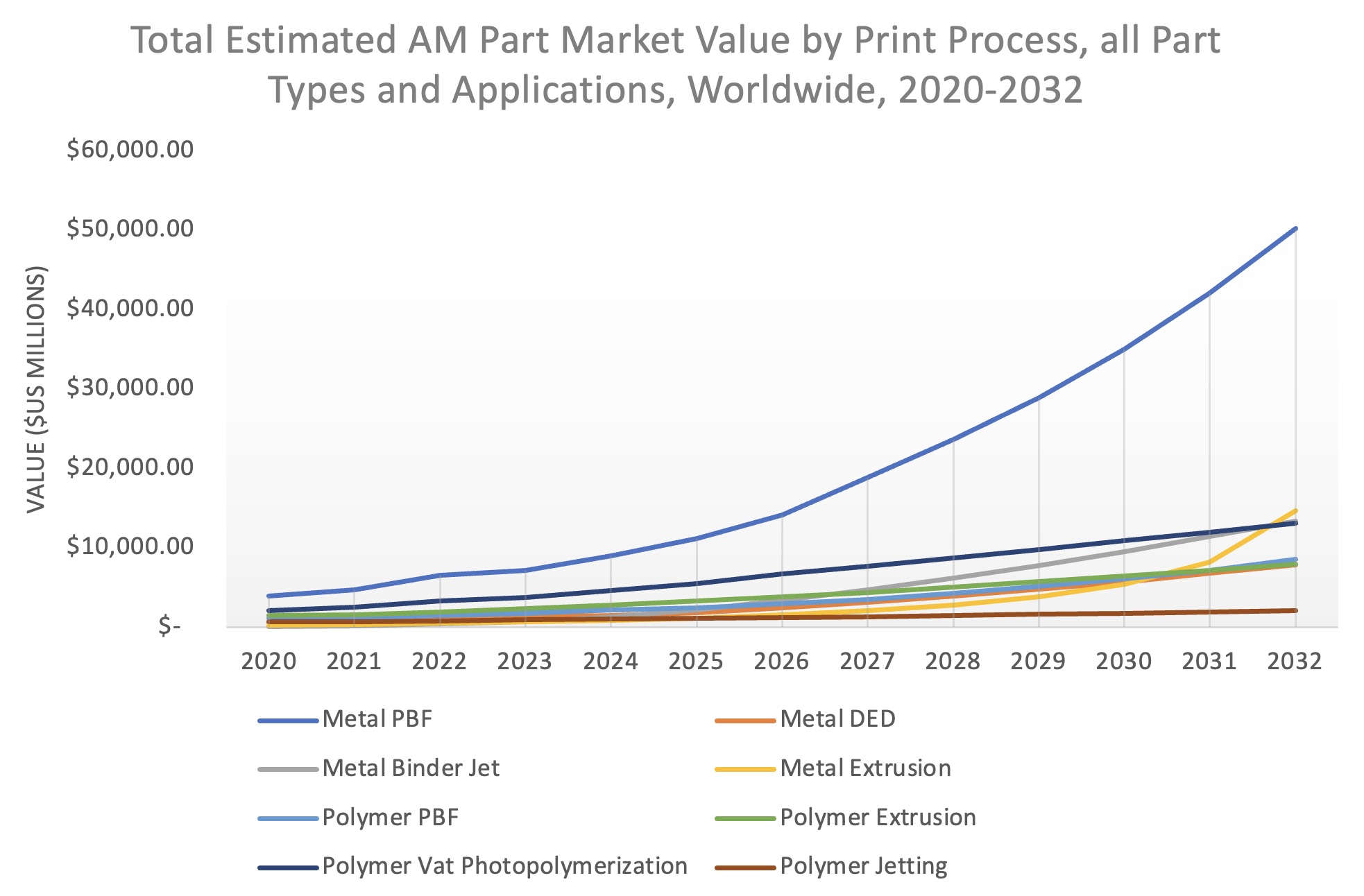

Additive Manufacturing Research has published the annual update of its AM Parts Produced 2023, which documents the production volumes and resulting estimated market values of various additively manufactured metal and polymer components.

The study reconfirms the positive long-term outlook for leading AM technologies moving into significant manufacturing roles across a multitude of industries over the coming decade, with print production activity eventually growing to exceed $100B annually.

This data-only report provides exhaustive data files (one for Metal 3D printed parts, and one for Polymer 3D printed parts) with historical and projected production volumes and resulting projected market value of AM parts spanning prototypes, tools and tooling, and end-use production parts across eight major industries and dozens of part categorizations, from aircraft and helicopter engine components in the aerospace industry, to nuclear reactor components in the energy sector. The data reflects real market activity through Q2 2023 and proprietary projections over the coming decade.

Total global metal additive prototyping growth slowed in 2023 compared to the prior year, as did production of additive tools, while end use part printing accelerated. Although its rate of growth slowed slightly compared to 2022, printing of metal tools and tooling using AM technologies grew nearly 41 percent in 2023.

The market for 3D printed polymer prototypes grew only 5 percent during the year. Still, overall polymer parts printing volumes grew thanks to uptake in end-use parts printed, led by material extrusion and powder bed fusion technologies. With the proliferation of relatively low cost, professional polymer powder bed fusion printers, AM Research now projects that the printing of end use polymer parts using powder bed fusion specifically will double that of material extrusion processes.

The dental sector has significant influence on AM print volumes, and in 2023 dental printing activity had mixed results. Global inflation and consumer spending impacts have largely decreased dental activity as often cited by clear dental aligner companies, and volumes of aligner thermoforming prints grew only 4 percent in the year worldwide.

Subscribe to our Newsletter

3DPresso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.